Section 125 Plans

Section 125 Cafeteria Plan: What It Is & How It Works

Looking for benefits that can attract and retain top talent?

Group Health Insurance Simplified

Choosing health benefits is one of the biggest business decisions you'll make. Let us help reduce the complexity, so you can get the most from your insurance plans.

Getting it right can lead to big pay-offs: a potential hire may see your offer as irresistible, and your current staff may be happier and more engaged.

You Can Access All the Benefits

- Access to a network of regional and national carriers — for plans that meet your business's and employees' needs at a competitive rate

- Receive year-round support to assist you every step of the way — such as enrollments, terminations, changes related to life events and renewals

- Integration with payroll, which can simplify changes in payroll deductions as a result of enrollments, life events and renewals

- Integration with carriers, so enrollment information is shared automatically, saving you time and reducing errors

Benefits Administration

Enrich the benefits experience for everyone in your organization with a solution that helps streamline administration, control costs and attract and retain talent. Benefits are essential to attracting and retaining talent. But for that to happen, benefits administration has to be easy and engaging, both for employees and HR practitioners. Our approach delivers such capabilities and much more.

With an industry-leading mobile experience and seamless carrier integrations, you can help make it simpler and more convenient for your people to manage their benefits. Plus, you'll have access to deep insights that can help you understand changing employee preferences and advanced technology to adapt accordingly.

Section 125 Cafeteria Plan (We Set This Up for You)

A cafeteria plan is a cost-effective way for businesses to sponsor benefits packages. It offers tax advantages for employers and employees alike and is a key component of many talent acquisition strategies.

What is a Section 125 Plan?

A section 125 plan allows employers to offer employees, their spouses and dependents certain benefits on a pretax basis, thereby lowering the employee's taxable income. It essentially puts more money back in the employee's pocket, which can help businesses attract and retain talent.

How Does It Work?

Employees can opt to have money deducted from their gross earnings to pay for qualified benefits, such as health insurance premiums, health flexible savings accounts (FSAs), health savings accounts (HSAs) or dependent care assistance programs (DCAPs). These deductions not only decrease the employee's taxable income, but also reduce the employer's payroll tax liabilities. To sponsor a section 125 plan, businesses must employ an average of 100 or fewer employees during either of the preceding two years.

Cafeteria Plan Benefits

In addition to being tax advantageous, cafeteria plans can help employers attract and retain talent. Employees today place great emphasis on having access to flexible benefits that improve the well-being of themselves and their families. When choosing between two prospective employers, a section 125 plan could be the deciding factor.

Types of Section 125 Plans

Common examples of cafeteria plans include:

Premium Only Plans (POP)

With this type of plan, an employee's pretax contributions can only be used to cover the cost of group health insurance premiums.

Flexible Savings Arrangements (FSA)

Employees enrolled in an FSA set aside pretax dollars, which can be used to reimburse qualified medical expenses. These plans have an annual maximum contribution limit and unused funds are lost at the end of the year.

Simple Cafeteria Plans

Employers with 100 employees or less can receive safe harbor from plan non-discrimination tests if they make the same benefit contributions to each eligible employee.

Full Flex Plans

Eligible employees purchase benefits using contributions from their employer. Any benefit not fully covered by the employer can be paid for by the employee via pretax payroll deductions.

What Benefits Are Included in Section 125?

The IRS considers the following to be qualified benefits under section 125:

- Group health benefits

- Accident and disability coverage

- Adoption assistance

- Dependent care assistance

- Group-term life insurance coverage

- Health savings accounts (HSAs)

What Benefits Are NOT Included in Section 125?

Benefits that don't meet section 125 requirements may still be offered by employers. They just can't be paid for with pretax dollars. Examples include, but are not limited to:

- Long-term care insurance

- Tuition assistance

- Employee discount programs

- Work cell phones

- Moving expenses

- Commuter benefits

- Gym memberships

- Minimal or de minimis benefits

How Do Employers Set Up a Section 125 Benefits Plan?

To set up a section 125 benefits plan, employers have to draft a document that outlines the benefits offered, contribution limits, participation rules and other information required by the IRS. They may also have to perform non-discrimination tests, depending on the plan, to ensure that it doesn't favor highly compensated or key employees. Without the proper knowledge, these tasks can be difficult, which is why many employers enlist the help of a third-party administrator to set up and manage their cafeteria plan.

How Do Employers Calculate Section 125 Benefits?

Employers who offer cafeteria plans generally process payroll as follows:

- Calculate employee gross earnings for the pay period

- Deduct contributions to section 125 cafeteria plans from gross income

- Withhold the applicable federal, state and local taxes from taxable income

- Calculate employer tax liabilities for FICA and federal and state unemployment

- Remit all payments to insurance providers and government agencies

These steps can be greatly simplified by working with us and integrating payroll and benefits to ensure that cafeteria plan contributions and taxes are calculated accurately each pay period and are in compliance with IRS codes.

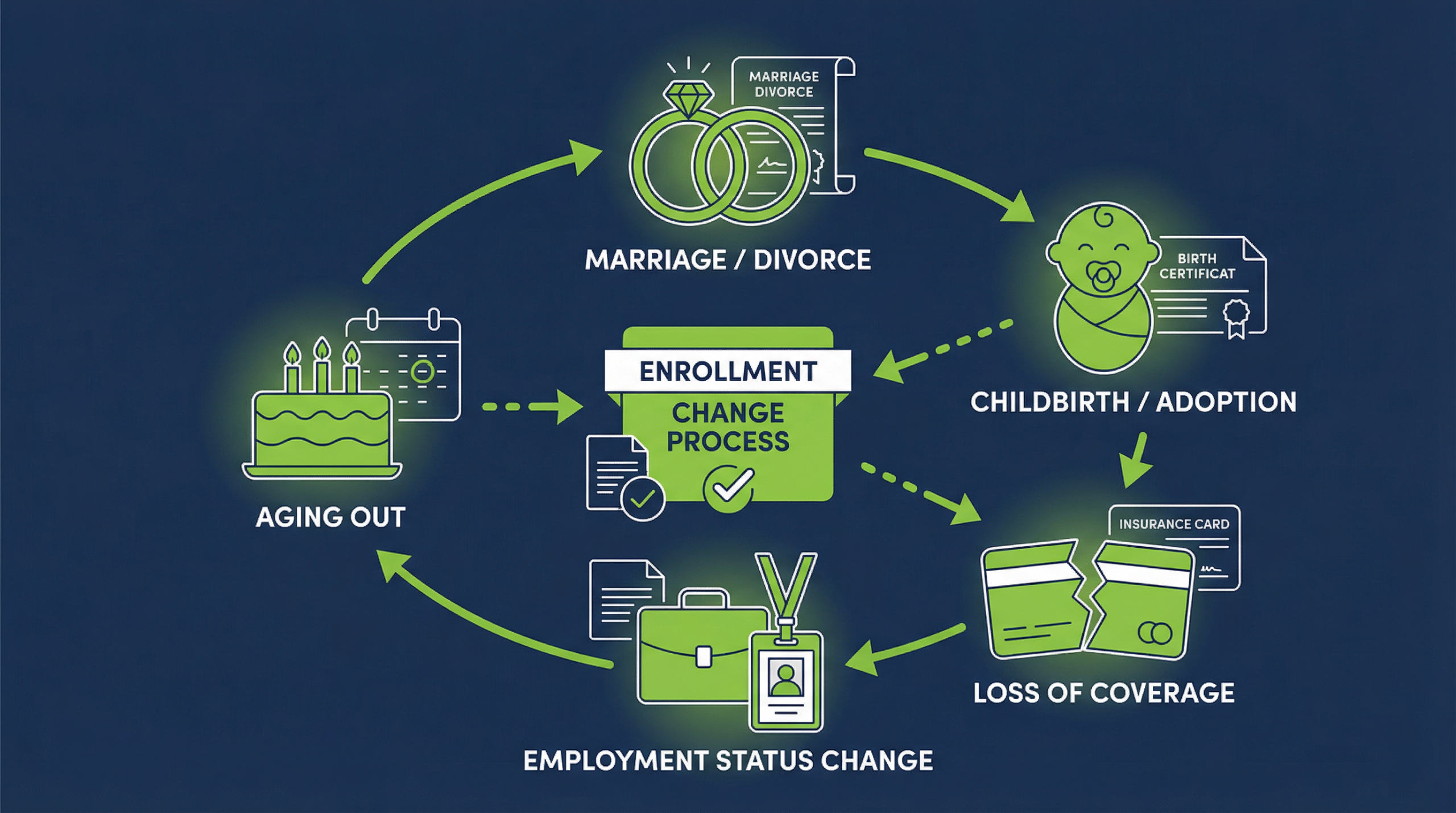

Section 125 Cafeteria Plan Qualifying Events

Once employees enroll in a cafeteria plan and make their selections, they generally cannot change them until the next open enrollment period unless they experience a qualifying life event, such as:

- Marriage, divorce or legal separation

- Childbirth or adoption

- Involuntary loss of coverage under another plan

- Change in employment status

- Aging out of a parent's plan

These circumstances in and of themselves are not enough to justify a special open enrollment. Employees usually have to provide a marriage license, birth certificate, letter from an insurance company or other documentation to prove their eligibility.

Who Can Sponsor a Section 125 Plan?

Generally, any employer with employees subject to U.S. income taxes can sponsor a cafeteria plan. This includes:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLC)

- C corporations

- S corporations

- Government entities

What is Covered Under a Section 125 Cafeteria Plan?

Cafeteria plans, depending on the provider, may cover a wide variety of medical services, including the following types of care:

- Medical

- Dental

- Vision

- Ambulatory

- Chiropractic

- Psychiatric

Certain prescription drugs may also be covered, as well as over-the-counter remedies, like allergy and cold medicine, first aid, pain killers, dietary supplements and more.

Frequently Asked Questions About Section 125 Plans

Ready to Set Up a 125 Cafeteria Plan?

We can help you save time and money while also boosting your employees' income. Sounds like a win-win.

Contact Us About Pricing Today