Employer Group Benefits

Employer Group Benefits

Supplemental insurance that complements your employee benefits

You want employees to be satisfied with their benefits—that's critical to attracting and retaining the best performers. You also need to manage costs to stay competitive and grow. Our worksite solutions help employers do both. You can provide the supplemental insurance your workforce wants AND manage the cost of doing so.

How It Works

We help communicate the value of the benefits your company offers, so employees understand what their total compensation is really worth. Then, we offer supplemental insurance policies and help them understand how these products complement their existing benefits. Employees recognize these as value-added benefits available as a result of their employment.

The Best Part for Your Company

Because these are supplemental policies paid for by employees directly, there is no additional cost to you and little or no administrative overhead. You get the benefit of dedicated account executives working with your employees and providing customer service—all of which your employees appreciate.

A Win-Win Solution

For Your Company

- Zero cost to employer

- Minimal administrative burden

- Attract and retain top talent

- Enhance employee satisfaction

- Competitive advantage in hiring

- Improved employee loyalty

For Your Employees

- Comprehensive protection options

- Affordable premiums through payroll

- Coverage gaps filled

- Financial security for families

- Easy enrollment process

- Dedicated customer service

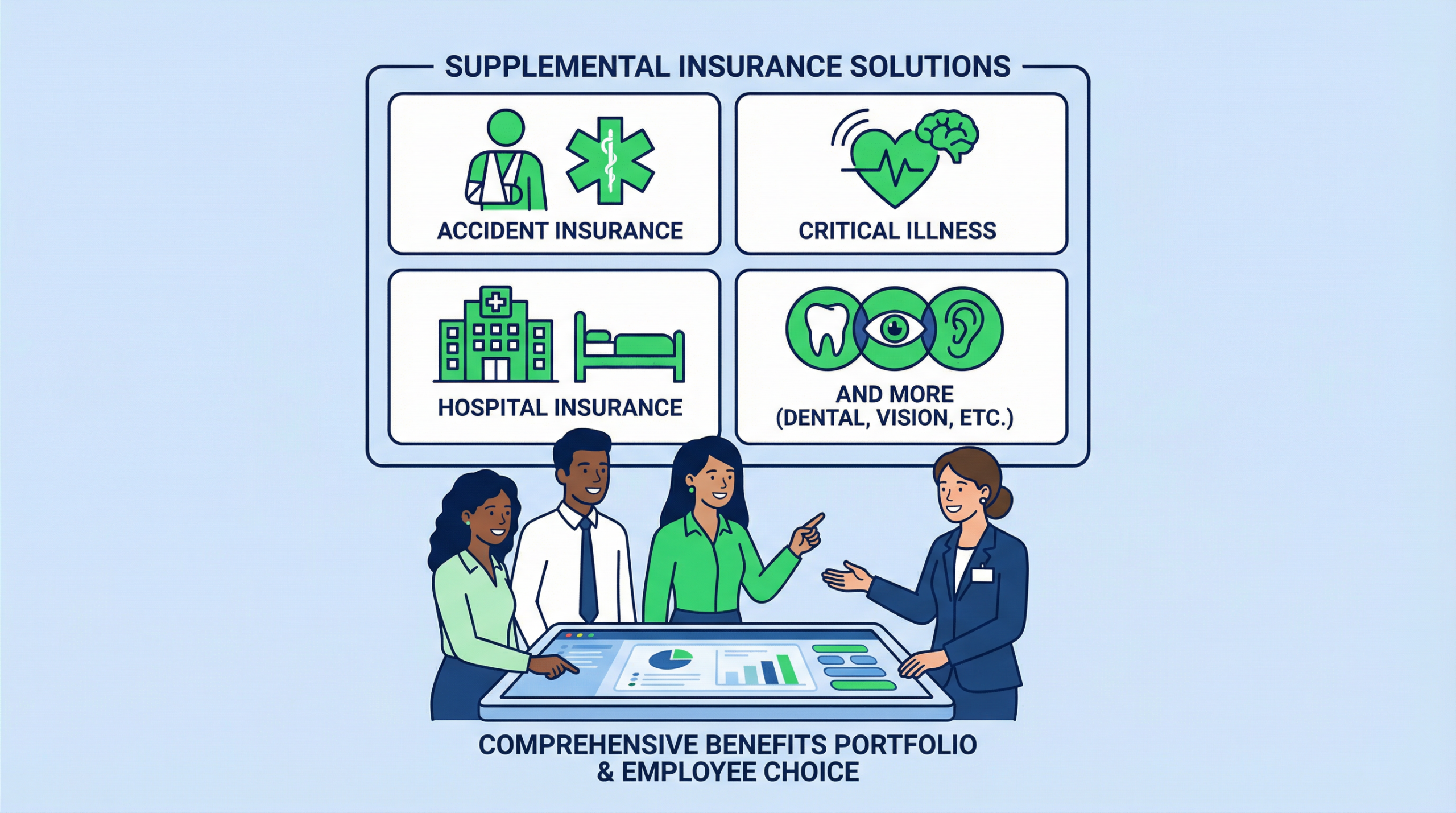

Supplemental Insurance Solutions

We offer a comprehensive portfolio of supplemental insurance products that complement your existing benefits package. Each solution is designed to fill specific coverage gaps and provide employees with the protection they need.

Accident Insurance

Cash benefits for covered accidental injuries, helping employees manage out-of-pocket costs for emergency care, treatment, and recovery.

Critical Illness Insurance

Lump sum payment upon diagnosis of covered serious conditions like cancer, heart attack, or stroke, providing financial support during treatment.

Hospital Insurance

Daily cash benefits for hospital stays, helping cover deductibles, copays, and everyday expenses while employees focus on recovery.

Dental & Vision

Affordable coverage for routine dental care and vision services, promoting preventive health and overall wellness.

Life Insurance

Financial protection for employees' families, providing peace of mind and security for the future.

Disability Insurance

Income replacement if employees are unable to work due to illness or injury, protecting their financial stability.

Easy Implementation & Support

Our dedicated account executives handle the heavy lifting. We provide comprehensive enrollment support, employee education, ongoing customer service, and claims assistance. Your HR team benefits from streamlined administration with minimal overhead, while your employees receive personalized attention and expert guidance throughout their coverage journey.

Enrollment Support

Professional enrollment specialists work directly with your employees to explain coverage options and help them make informed decisions.

Employee Education

Clear communication materials and presentations that help employees understand the value of supplemental insurance and how it complements their existing benefits.

Ongoing Service

Dedicated customer service team available to answer questions, process changes, and provide support throughout the year.

Partner with Us

For over 100 years, we've been helping employers provide comprehensive benefits solutions that attract and retain top talent. Our supplemental insurance programs are designed to enhance your benefits package without adding to your costs. Let us show you how easy it is to offer your employees the protection they need while strengthening your competitive position in the marketplace.