Disability Insurance

Disability Insurance

Safeguard your income with Disability Insurance

In the event of a heart attack, stroke, cancer, or other critical illness or injury, Disability Insurance offers an easier way to get the help you deserve. When sudden illness or injury sidelines you from work, this policy helps replace a portion of your paycheck, allowing you to focus on recovery without the added stress of financial hardship.

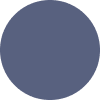

What Does Disability Insurance Cover?

Disability Insurance helps protect your income if sudden illness or injury sidelines you from work. The policy replaces a part of your paycheck, providing cash benefits you can use to help cover essential expenses while you recover.

Car Payments

Keep up with your vehicle loan or lease obligations to maintain your transportation independence. Your disability benefits help ensure you don't fall behind on essential payments during recovery.

Student Loans

Continue meeting your federal and private student loan installments without interruption. Protect your educational investment and credit standing while you focus on getting better.

Household Costs

Cover mortgage or rent, utilities, groceries, and daily living expenses to maintain your family's standard of living. Ensure financial stability for your household during your time away from work.

Stanley's Story: Recovering Without Financial Worry

When Stanley, a factory foreman, broke his leg in a workplace accident, both healing and physical therapy meant he would be out of work for months. Thankfully, Stanley had taken out a Disability Insurance plan through his employer, which replaced a portion of his income. This financial security allowed Stanley to focus on healing without worrying about bills. With his health on the mend, Stanley was soon able to return to the factory floor, confident that his insurance had protected his family's financial well-being during a challenging time.

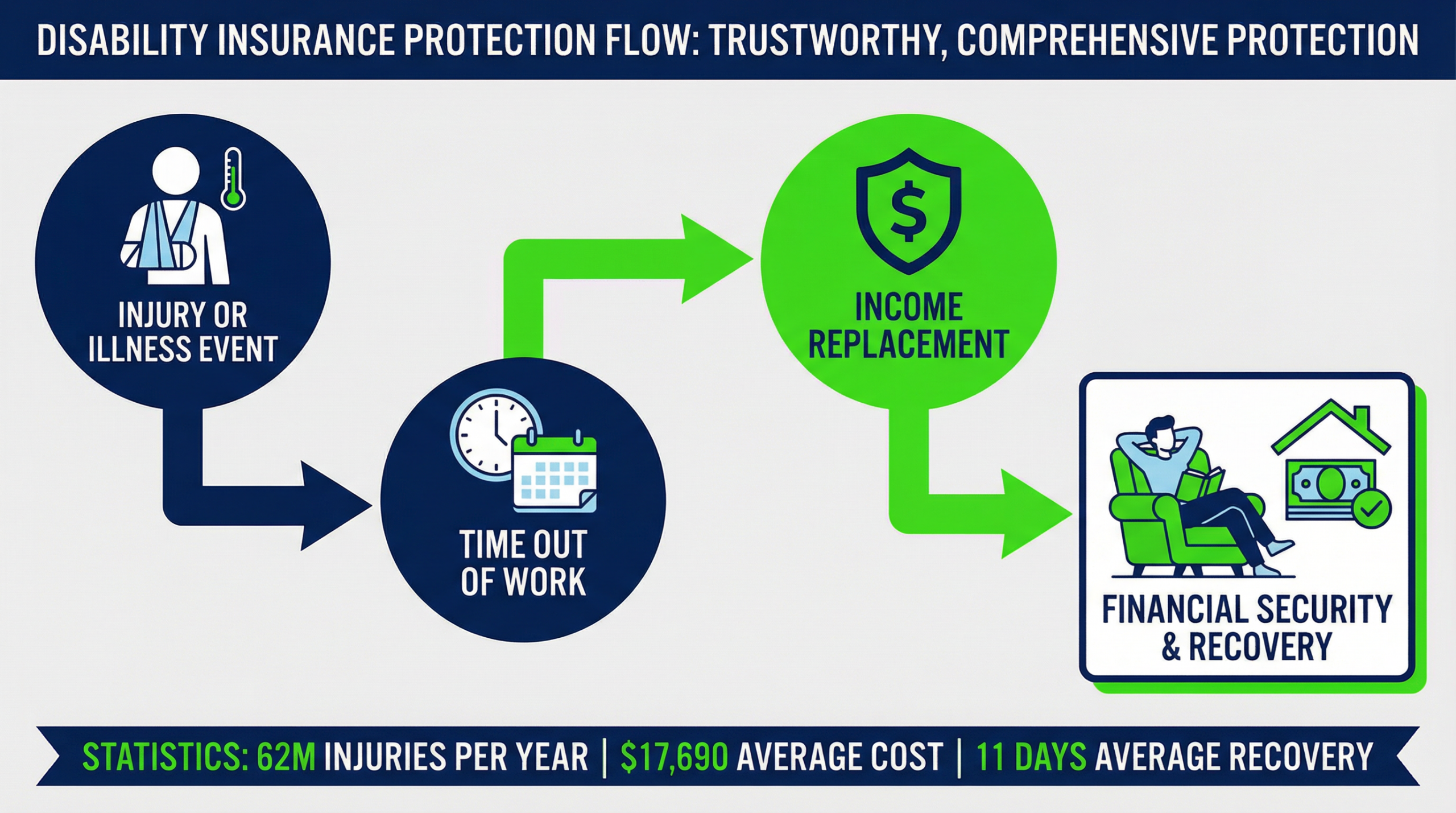

How Disability Insurance Protects You

Disability can happen to anyone, at any time. But with Disability Insurance, for each day you are out of work due to a covered illness or injury, you'll receive benefits to supplement your lost income. This protection ensures that an unexpected health event doesn't derail your financial stability or your family's future.

Why Choose Disability Insurance?

Income Replacement

Receive cash benefits for each day you're unable to work due to a covered illness or injury. Maintain financial stability when you need it most.

Flexible Use of Benefits

Benefits are paid directly to you, giving you the freedom to use them for any expense—medical bills, household costs, or daily necessities.

Peace of Mind

Focus on recovery without the added stress of financial hardship. Know that your income is protected while you heal.

Comprehensive Protection

Coverage for a wide range of illnesses and injuries, including heart attacks, strokes, cancer, and workplace accidents.

Affordable Coverage

Supplemental disability insurance is designed to be affordable, providing valuable protection without breaking your budget.

Easy Claims Process

Streamlined claims submission and processing to get you the benefits you need quickly and efficiently.

Where Confidence Meets Coverage

We've been a leader in supplemental insurance for over 100 years. We provide individuals, families, and businesses with supplemental benefits that help fill coverage gaps and take insurance protection further. With unparalleled claims submission, seamless support tailored to your needs, and a team that's by your side along the way, we're here to help you face disability with financial confidence and peace of mind.