Cancer Insurance

Cancer Insurance

Protection you can count on with Cancer Insurance

Planning for the unexpected is challenging, but you can manage the financial implications of a life-changing diagnosis with Cancer Insurance. You'll receive cash benefits to help cover expenses associated with cancer treatment and recovery, allowing you to focus on what matters most—your health and your family.

What Does Cancer Insurance Cover?

Cancer Insurance pays cash benefits to help cover a range of out-of-pocket medical and non-medical expenses during your treatment. These benefits are paid directly to you, giving you the flexibility to use them where you need them most.

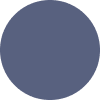

Peace of Mind

Reduces financial stress, allowing you to focus on recovery and emotional well-being. Provides a sense of security and stability for you and your family during a difficult time.

Cash to Cover Treatment Costs

Lump sum or reimbursement for medical bills, hospital stays, surgeries, and treatments not fully covered by primary insurance. Includes costs for advanced therapies and second opinions.

Everyday Living Expenses

Helps cover non-medical household bills, rent or mortgage, groceries, childcare, transportation, and daily costs to maintain your lifestyle during treatment and recovery periods.

Juan's Story: Fighting Cancer Without Financial Burden

When Juan was diagnosed with colon cancer, he was worried about how he would continue to provide for his household. Thankfully, he had taken out a Cancer Insurance policy. He used the benefits to help cover a portion of his medical bills. The benefits from his cancer policy allowed Juan to focus on recovery and not finances. He fought cancer head-on and made a full recovery.

Why Choose Our Cancer Insurance?

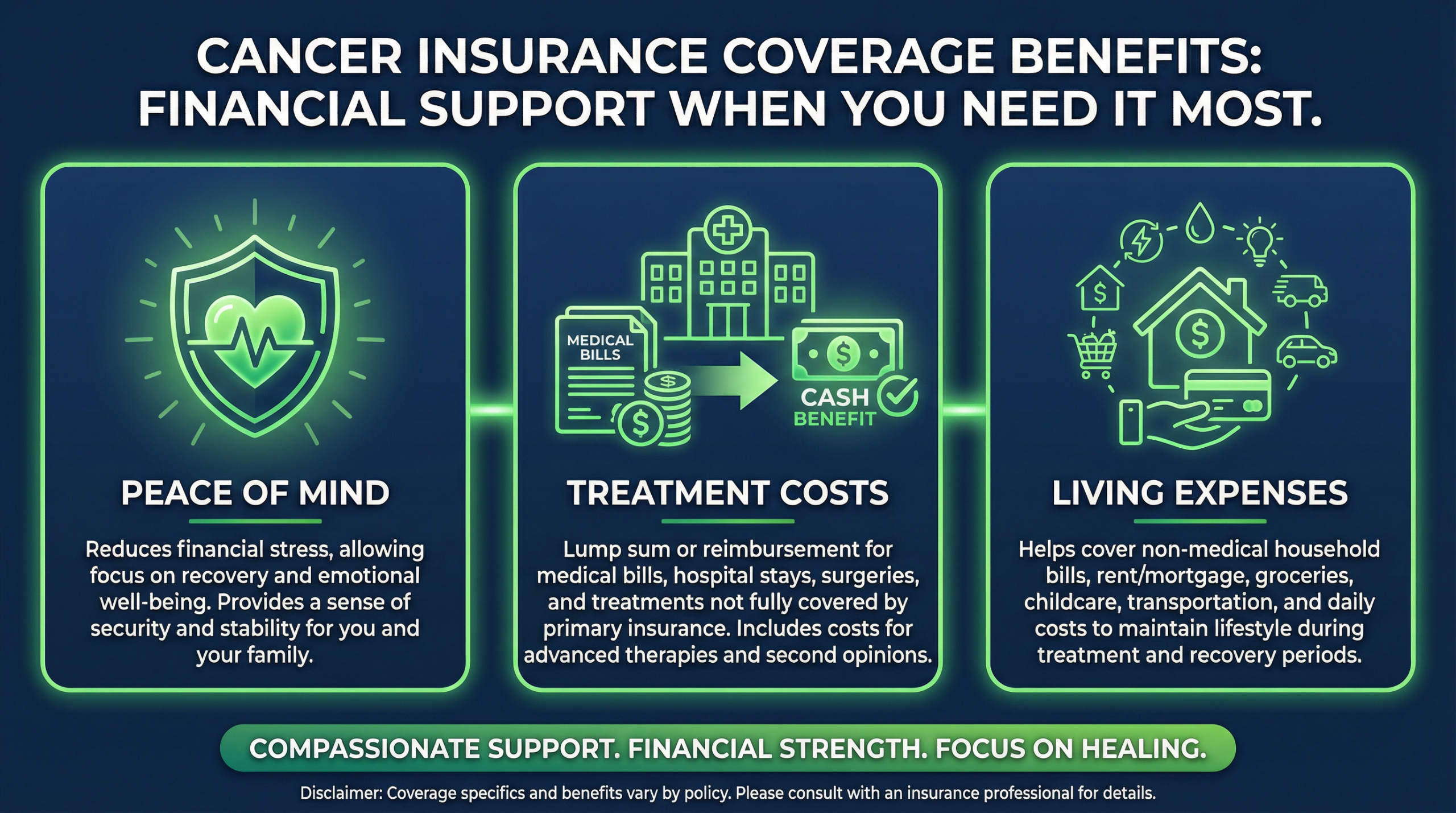

Portable Coverage

Your coverage stays with you even if you leave your present job. Protection that travels with you through life's transitions and career changes.

Guaranteed Rates

Your rate will never change and your benefits will never decrease due to your age. Predictable premiums you can count on for life.

Cannot Be Cancelled

Coverage cannot be cancelled as long as your premiums are paid as due. Your policy is yours to keep, providing long-term security.

Family Coverage

Coverage is also available for your spouse and dependent children under the age of 18. Comprehensive protection for your entire family.

HSA Compatible

Owning this coverage does not disqualify you from having a Health Savings Account. Maximize your tax-advantaged savings while maintaining protection.

Direct Payment to You

Benefits are paid directly to you, not to medical providers. Use the funds however you need to support your treatment and recovery journey.

Where Confidence Meets Coverage

We've been a leader in supplemental insurance for over 100 years. We provide individuals, families, and businesses with supplemental benefits that help fill coverage gaps and take insurance protection further. With unparalleled claims submission, seamless support tailored to your needs, and a team that's by your side along the way, we're here to help you face a cancer diagnosis with financial confidence and peace of mind.