Employer Group Benefits

Employer Group Benefits

Supplemental insurance that complements your employee benefits

You want employees to be satisfied with their benefits—that's critical to attracting and retaining the best performers. You also need to manage costs to stay competitive and grow. Our worksite solutions help employers do both. You can provide the supplemental insurance your workforce wants AND manage the cost of doing so.

How It Works

We help communicate the value of the benefits your company offers, so employees understand what their total compensation is really worth. Then, we offer supplemental insurance policies and help them understand how these products complement their existing benefits. Employees recognize these as value-added benefits available as a result of their employment.

The Best Part for Your Company

Because these are supplemental policies paid for by employees directly, there is no additional cost to you and little or no administrative overhead. You get the benefit of dedicated account executives working with your employees and providing customer service—all of which your employees appreciate.

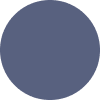

A Win-Win Solution

For Your Company

- Zero cost to employer

- Minimal administrative burden

- Attract and retain top talent

- Enhance employee satisfaction

- Competitive advantage in hiring

- Improved employee loyalty

For Your Employees

- Comprehensive protection options

- Affordable premiums through payroll

- Coverage gaps filled

- Financial security for families

- Easy enrollment process

- Dedicated customer service

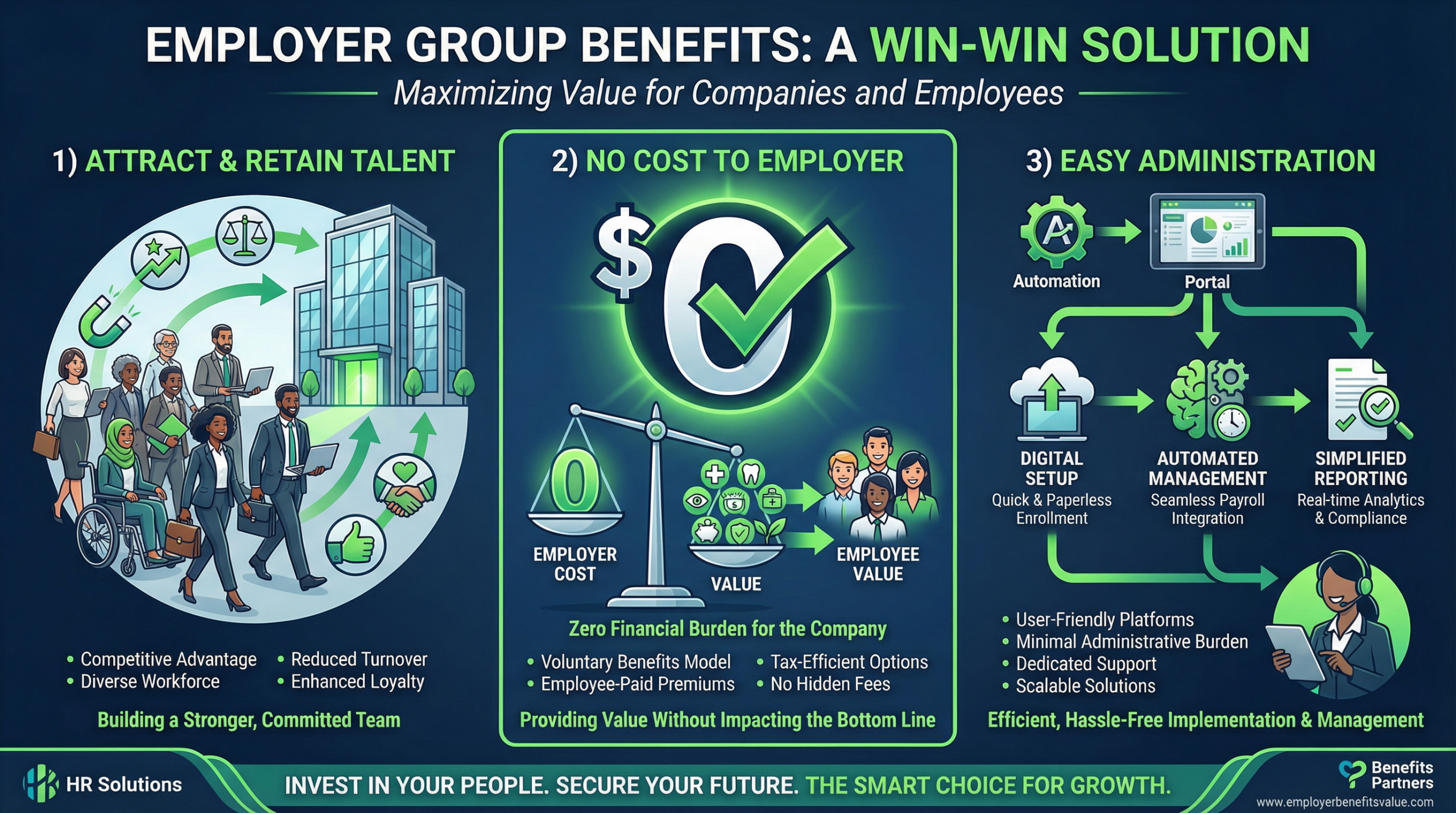

Supplemental Insurance Solutions

We offer a comprehensive portfolio of supplemental insurance products that complement your existing benefits package. Each solution is designed to fill specific coverage gaps and provide employees with the protection they need.

Accident Insurance

Cash benefits for covered accidental injuries, helping employees manage out-of-pocket costs for emergency care, treatment, and recovery.

Critical Illness Insurance

Lump sum payment upon diagnosis of covered serious conditions like cancer, heart attack, or stroke, providing financial support during treatment.

Hospital Insurance

Daily cash benefits for hospital stays, helping cover deductibles, copays, and everyday expenses while employees focus on recovery.

Dental & Vision

Affordable coverage for routine dental care and vision services, promoting preventive health and overall wellness.

Life Insurance

Financial protection for employees' families, providing peace of mind and security for the future.

Disability Insurance

Income replacement if employees are unable to work due to illness or injury, protecting their financial stability.

Easy Implementation & Support

Our dedicated account executives handle the heavy lifting. We provide comprehensive enrollment support, employee education, ongoing customer service, and claims assistance. Your HR team benefits from streamlined administration with minimal overhead, while your employees receive personalized attention and expert guidance throughout their coverage journey.

Enrollment Support

Professional enrollment specialists work directly with your employees to explain coverage options and help them make informed decisions.

Employee Education

Clear communication materials and presentations that help employees understand the value of supplemental insurance and how it complements their existing benefits.

Ongoing Service

Dedicated customer service team available to answer questions, process changes, and provide support throughout the year.

Partner with Us

For over 100 years, we've been helping employers provide comprehensive benefits solutions that attract and retain top talent. Our supplemental insurance programs are designed to enhance your benefits package without adding to your costs. Let us show you how easy it is to offer your employees the protection they need while strengthening your competitive position in the marketplace.

Frequently Asked Questions

Our worksite solutions representatives are ready to work with you to add value to your company's benefits plan—without additional cost or administrative overhead for your organization. Below are answers to common questions about managing supplemental insurance benefits for your employees.

Common Questions

You will receive a detailed billing statement that clearly lists each participating employee and their corresponding premium amount. This statement serves as your guide for payroll deductions. The bill will include employee names, policy information, and the exact amount to deduct from each participant's paycheck for the billing period.

If you have any questions about the amounts listed or need clarification on any employee's deduction, our customer service team is available to assist you in reviewing the billing details.

Your billing statement is sent on a regular schedule, typically monthly, to ensure you have adequate time to process payroll deductions before the payment due date. The exact timing of your bill delivery depends on your billing cycle, which is established when your group policy is set up.

You can expect to receive your bill with sufficient lead time to make the necessary payroll adjustments and remit payment by the due date. If you need to adjust your billing schedule or have questions about when to expect your next statement, please contact our billing department.

If the amount deducted from an individual's pay is more or less than the billed amount for that individual, simply cross through the billed amount and note the revised amount in the "Amount Paid" column. If you know why the amount is different, please indicate the reason for the difference.

If you have been making deductions for an employee whose name does not appear on the bill, simply write in the employee's name and amount deducted on the bill. We will contact the employee directly regarding any premium shortage. We will also refund any overpayment directly to the employee, unless you instruct us to handle it differently.

When an employee terminates employment, you should notify us as soon as possible so we can update our records and adjust future billing accordingly. Most supplemental insurance policies are portable, meaning the employee can continue their coverage by paying premiums directly to us after leaving your organization.

Simply note the termination date on your billing statement or contact our customer service team with the employee's information and last day of employment. We will handle the transition and work directly with the former employee to continue their coverage if they choose to do so. You are only responsible for deductions through the employee's last day of active employment.

We offer several convenient payment options to make remitting your bill as easy as possible. You can pay by check, electronic funds transfer (EFT), or through our online payment portal. Your billing statement will include detailed instructions for each payment method, including where to send checks and how to access the online payment system.

Many employers find electronic payment methods to be the most efficient, as they reduce processing time and provide immediate confirmation of payment. If you would like to set up automatic payments or electronic funds transfer, please contact our billing department to arrange the setup.

The payment due date is clearly indicated on your billing statement. Typically, payments are due within a specified number of days from the statement date to ensure continuous coverage for all participating employees. It's important to remit payment by the due date to avoid any lapse in coverage or late fees.

If you anticipate any difficulty meeting a payment deadline, please contact us as soon as possible. We're here to work with you and can discuss options to ensure your employees' coverage remains uninterrupted.

Our dedicated customer service team is available to answer any questions you may have about billing, enrollment, coverage, or administrative processes. You can reach our support team during regular business hours, and we're committed to providing prompt, helpful assistance.

Your billing statement includes contact information for our customer service department. Additionally, you may have a dedicated account representative assigned to your organization who can provide personalized support and guidance. We're here to make managing your employees' supplemental benefits as simple and efficient as possible.

Still Have Questions?

Our team is here to help. We're committed to providing exceptional service and support to make administering supplemental insurance benefits easy for your organization. Whether you have questions about billing, enrollment, coverage options, or any other aspect of our worksite solutions, we're just a phone call away.

We understand that every organization has unique needs and circumstances. Our experienced representatives are ready to provide personalized assistance and work with you to ensure your employees have access to valuable supplemental insurance benefits with minimal administrative burden on your team.