How To Setup WIMPER 125

Guide to Setting Up a Section 125 WIMPER Plan

What is a WIMPER Plan?

WIMPER stands for Wellness and Integrated Medical Plan Expense Reimbursement. Think of it as a bundle: wellness resources to keep people healthy, plus a structured way to reimburse eligible medical expenses—organized under a Section 125 Cafeteria Plan so employees can pay for benefits with pre-tax dollars.

Why Employers Like WIMPER

- Lower payroll taxes (thanks to pre-tax elections)

- Better benefits without blowing the budget

- Healthier, more engaged teams

- A competitive edge in hiring and retention

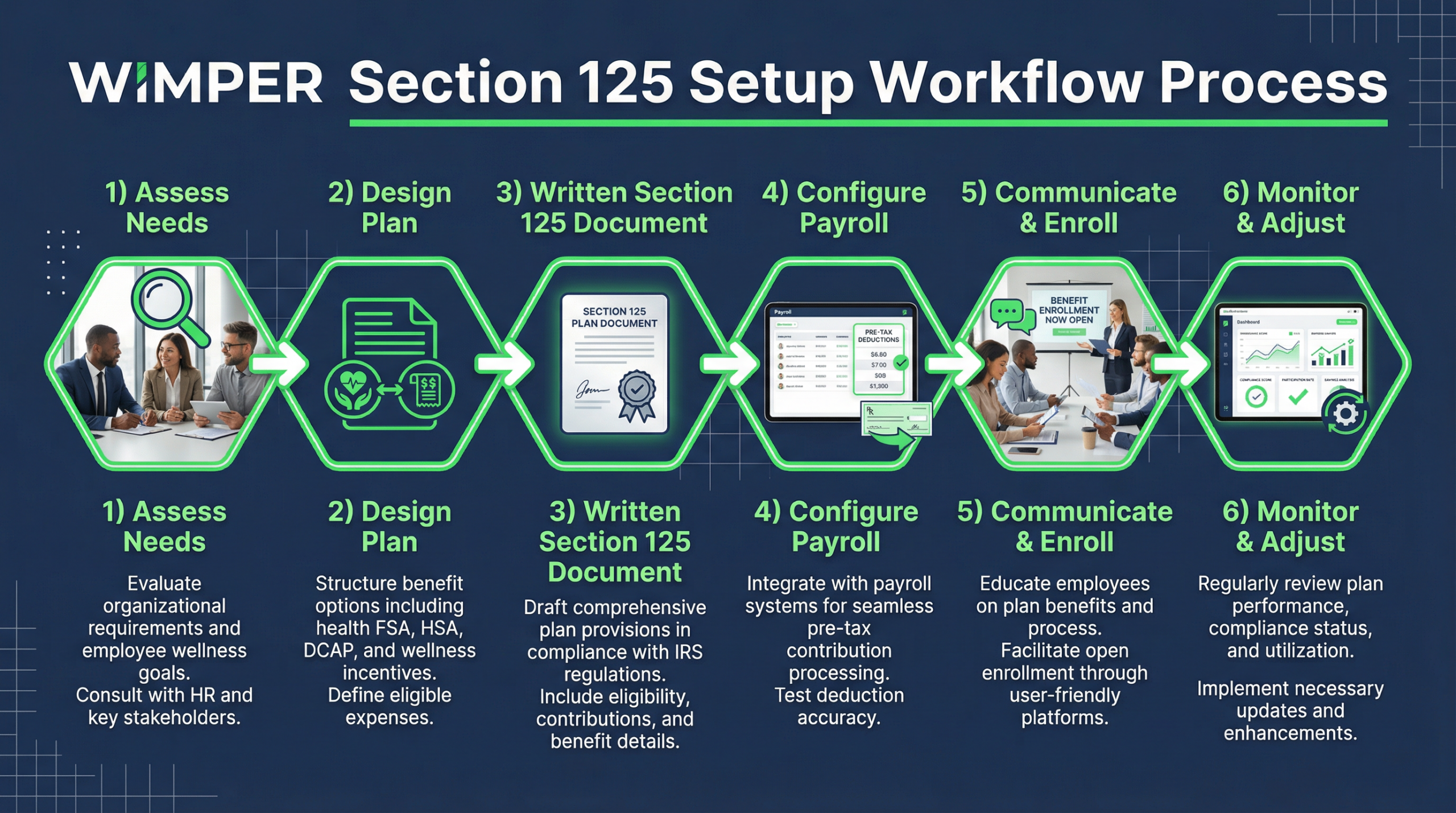

How It Works—In One Quick Flow

Assess needs → Design plan (wellness + reimbursements) → Put it in a written Section 125 document → Configure payroll pre-tax deductions → Communicate and enroll → Monitor compliance and adjust

What to Include

1. Section 125 Cafeteria Plan (the tax-advantaged backbone)

The foundation that allows employees to make pre-tax benefit elections, reducing both employee and employer tax liability.

2. Wellness Program (telehealth, preventive care, coaching)

Comprehensive wellness resources including telehealth services, preventive care screenings, and health coaching to keep employees healthy and engaged.

3. Medical Reimbursements (eligible expenses only)

Structured reimbursement for qualifying medical expenses as defined by IRS guidelines, ensuring compliance and proper substantiation.

4. Compliance Infrastructure (nondiscrimination testing, clear election rules)

Built-in compliance framework including annual nondiscrimination testing, proper documentation, and clear rules for benefit elections and changes.

Common Pitfalls to Avoid

- Treating reimbursements like cash compensation – Reimbursements must be for eligible medical expenses only, not general compensation

- Loose documentation and weak substantiation – Every reimbursement must be properly documented and substantiated with receipts

- Ignoring annual nondiscrimination testing – IRS requires annual testing to ensure the plan doesn't favor highly compensated employees

- Overcomplicating enrollment communications – Keep communications clear, simple, and employee-friendly to maximize participation

Getting Started: A Simple Checklist

Bottom Line

WIMPER plans can be a smart, compliant way to stretch your benefits dollars and support a healthier workforce. Keep the design simple, document everything, and measure outcomes—your employees and your budget will thank you.

Q&A Section

We Set Up and Implement for You

We set up for you and implement it without the headaches and in compliance with all regulations. Consult with us and understand the program.

Consult With Us Today